Our Firm

Excelsa is a real estate asset manager focused on U.S. multifamily assets, backed by a team of seasoned professionals.

What Sets Excelsa Apart

At Excelsa, our commitment to transparency, structuring flexibility and operational excellence governs everything we do and helps create sustainable value for our investors.

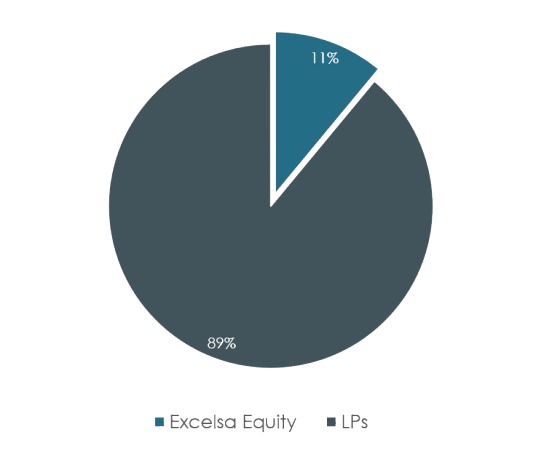

Excelsa Equity Contribution Across US Portfolio

Our Leadership

ESG Governance

Our commitment to environmental, social and governance (ESG) principles guides everything we do, ensuring that our investments and operations create lasting, positive impact.

We believe that sustainability, social responsibility and ethical governance are not just obligations, they are essential to driving long-term growth, managing risk, and delivering value to our investors, employees and communities.

Learn More

Reach out today to discuss how Excelsa can help you meet your investment objectives.