19

# of Multifamily Properties Acquired

3,763

# of Multifamily Units Acquired

2.86x

Realized MOIC on Multifamily

>9.3%

Realized C-o-C on Multifamily

~17.5%

Realized IRR on Multifamily

Investment Vehicles

First Investment

Started out as a family office with a buy-and-hold strategy investing in multifamily in the DC Area (Aquila Portfolio)

First Syndications

- Office investment in Charleston, SC

- Student housing investment in Charleston, SC

First Exit

Launch of Excelsa US Real Estate I LP (EUSRE I)

Excelsa fully transitioned to an asset manager.

The company acquired 10 properties between 2018 and 2022, with six exits so far.

Launch of Excelsa US Real Estate II LP (EUSRE II)

Acquired six properties

Portfolio Snapshot

Our multifamily portfolio is diversified geographically and we have built an expertise in value add properties that deliver higher returns

Deal parameters

Prefered deal size: $50-150 MM

Prefered equity ticket: $15-50 MM

Acquisition Timeline

Our deal execution is designed to optimize returns at every stage of the market cycle.

2009

2010

2011

2015 Exit

2018

2019

2020

2021

2022

2022 Exit

Bend at Oak Forest2023

2024

Why multifamily?

Why invest in US Multifamily?

Excelsa is primarily focused on the multifamily real estate asset class in the US, a market with strong fundamentals compared to other asset classes

Favorable Demographic Conditions

Growing population, changes in housing preferences, and affordability constraints are creating a strong demand for rental housing.

Hedge Against Inflation

Multifamily investments can generate higher cash flows and act as an inflation hedge through rental income increases and appreciation in value.

Lower Volatility

Multifamily investments offer a consistent stream of rental income from multiple units, stabilizing cash flow and minimizing the fluctuations in the broader market.

Government-Backed Financing

Multifamily properties benefit from streamlined access to borrowing facilities, especially government-sponsored entities like Freddie Mac and Fannie Mae, which are renowned for their financing programs tailored specifically for multifamily investments.

Attractive Returns

Multifamily properties offer a favorable investment opportunity relative to other asset classes providing a steady cash flow and potential for appreciation.

Liquid Markets for Transactions

Due to higher demand, consistent cash flows, and availability of financing options, multifamily investments offer relatively larger liquid markets.

Regional Focus

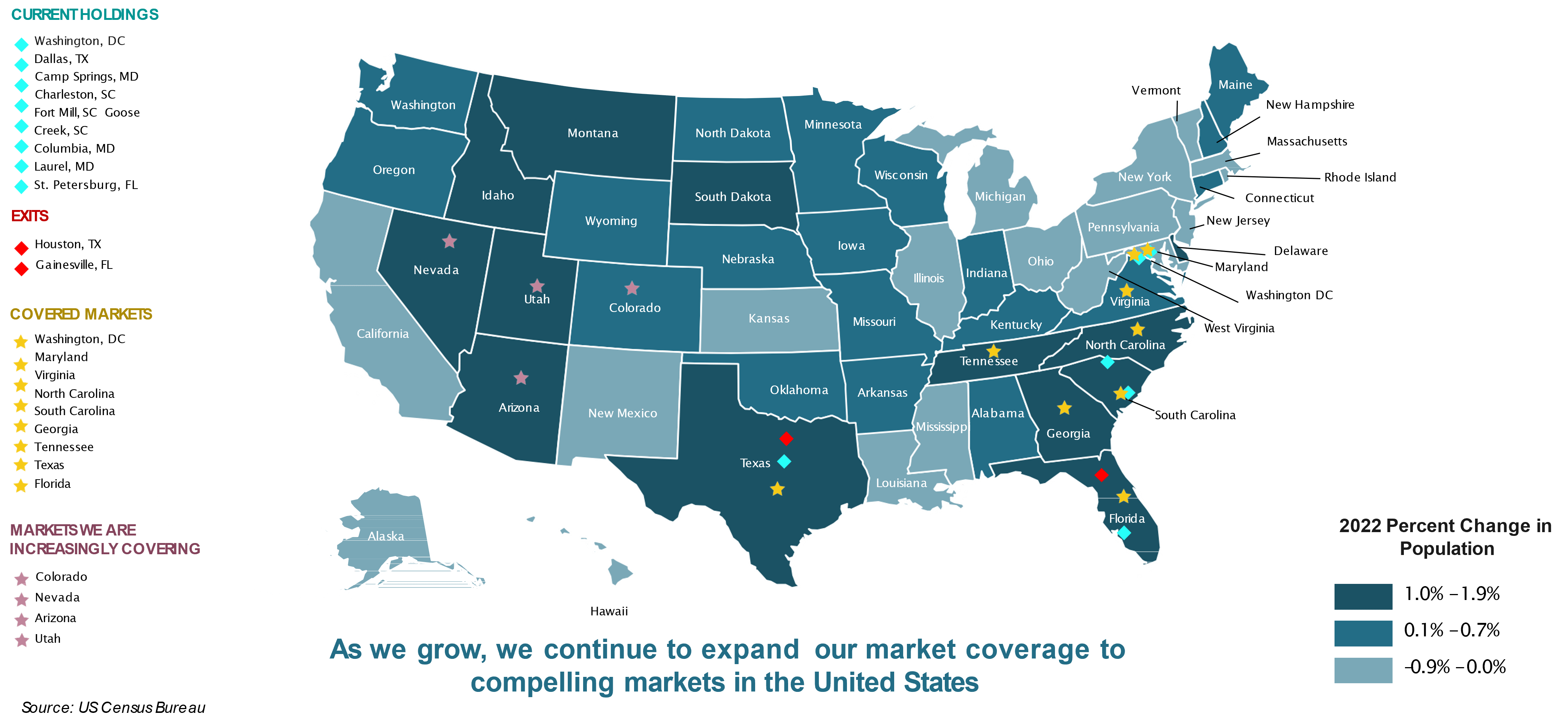

We favor geographic areas that are experiencing positive job growth and migration with a focus on the Sun Belt.

As we grow, we continue to expand our market coverage to compelling markets in the Western United States.